When you received your Notice of Appraised Value this year, you may have noticed several different values printed on it. Having multiple and different values on the notice can be confusing, especially with regards to the Homestead Exemption and the “homestead cap”. Below, we have attempted to clarify differences between two of these values and to explain how the homestead cap affects these values.

Market Value

Per the Texas Property Tax Code, all taxable property must be valued at 100% of market value as of January 1 each year. This value is shown on your notice as “Total Market Value”. Because it is based on recent sales, the Total Market Value may change upwards or downwards any amount depending on recent market trends and IS NOT limited to increases of 10% or more. It may change as much as the current market changes.

Assessed Value (“Homestead Cap Value”)

Per the Texas Property Tax Code, an exemption for taxation is available to an individual’s primary residence. One of the features of the exemption is a limit to the amount that the value for taxation can increase from one year to the next. This limit is frequently referred to as the “homestead cap”. The “capped” value is shown as the “Assessed Value” and is located at the bottom of the list of values on your notice or online. The assessed value IS limited by the Homestead Exemption and may not go up more than 10% in one year in most cases as long as the exemption was in place for the prior year for the current owner. This number is calculated using the previous year’s Assessed Value and a “cap” of 10%.

For example:

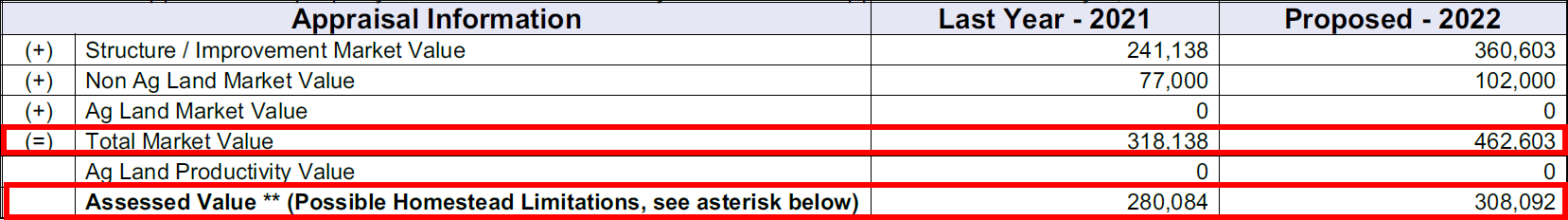

In 2021, a property with a Homestead Exemption had a market value of $318,138 and an assessed value of $280,084. For 2022, the subject’s market value increased to $462,603, but the assessed value is limited to the previous year’s assessed value ($280,084) plus 10% of that value ($280,084 x 10% = $28,008). The assessed value for 2022 is $308,092. This taxpayer’s value for taxes is starting at $308,092 instead of $462,603 in 2022.

This example would look like the following summary on their 2022 Notice of Appraised Value:

**A residence homestead is protected from future assessed value increases in excess of 10% per year from the date of the last assessed value plus the value of any new improvements. (The limitation takes effect to a residence homestead on January 1 of the tax year following the first year the owner qualifies the property for the residential homestead exemption. [Section 23.23(c) Texas Property Tax Code])

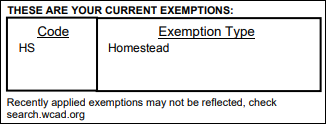

Do I have a homestead exemption?

A property with a homestead exemption will have an “HS” code listed in exemptions on the Notice of Appraised Value and on WCAD's website: Near the top of the notice:

Listed on the property details in WCAD's online property search. It can be found in two locations:

- In the Owner Information section

- In the Entities and Exemptions section

For even more information related to Homestead caps, check out our knowledge base article at:

https://support.wcad.org/portal/en/kb/articles/hs-cap

If you wish to apply for the Homestead exemption on your primary residence, visit https://www.wcad.org/online-exemption-information/ to get started.